SEEK NZ Employment Report - January

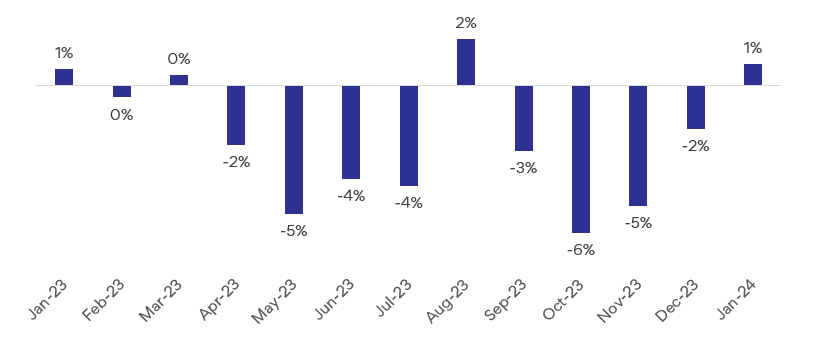

- Job ads rose for the first time since August, up 1% month-on-month (m/m).

- Applications per job ad rose another 6%, making competition for roles extremely tight.

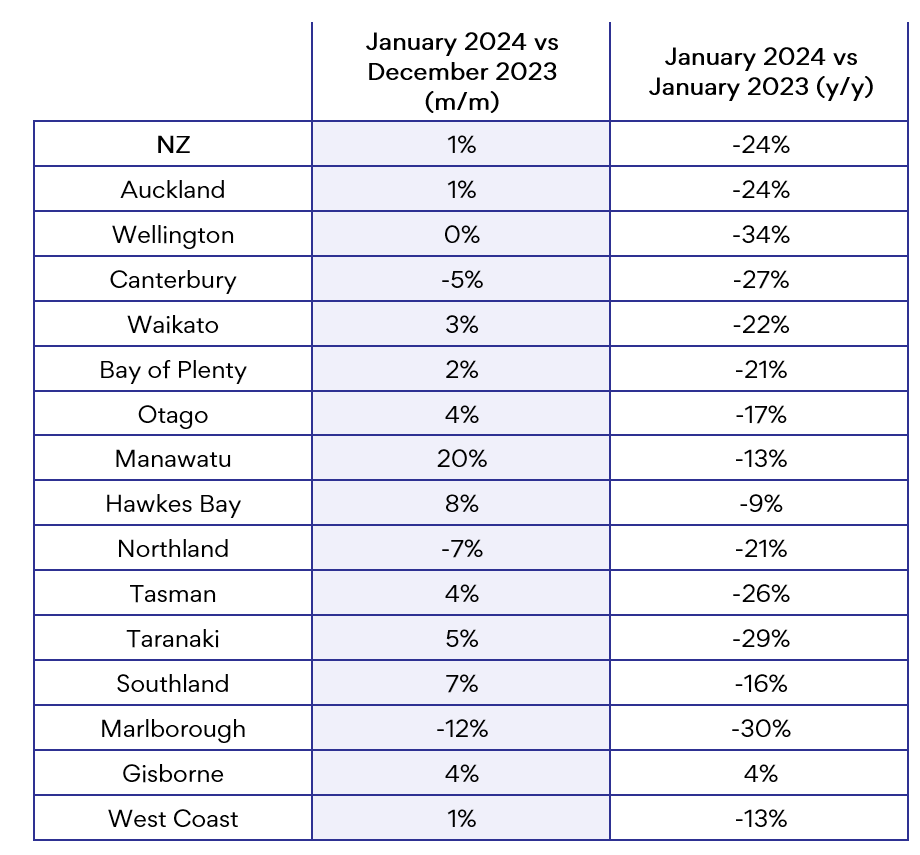

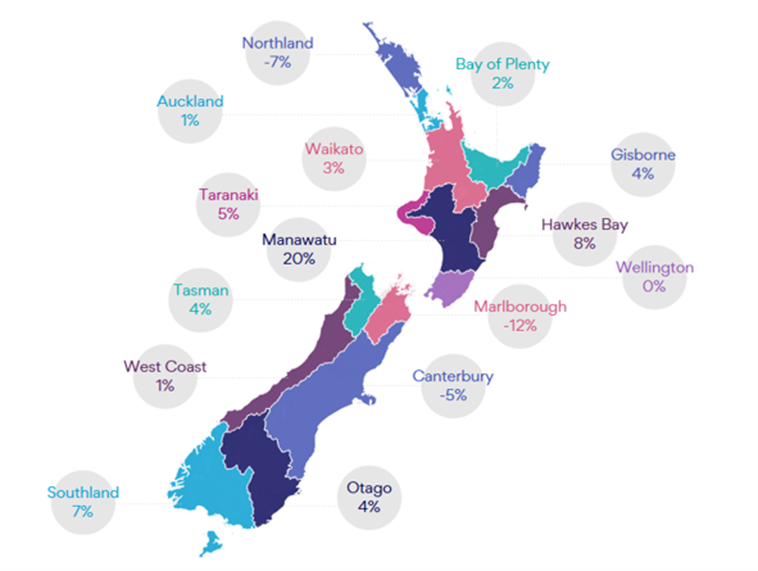

- A 20% increase in Manawatu led the national growth in job ads for the month, followed by Auckland (1%).

- The regions to record a decline m/m were Canterbury (-5%), Northland (-7%) and Marlborough (-12%).

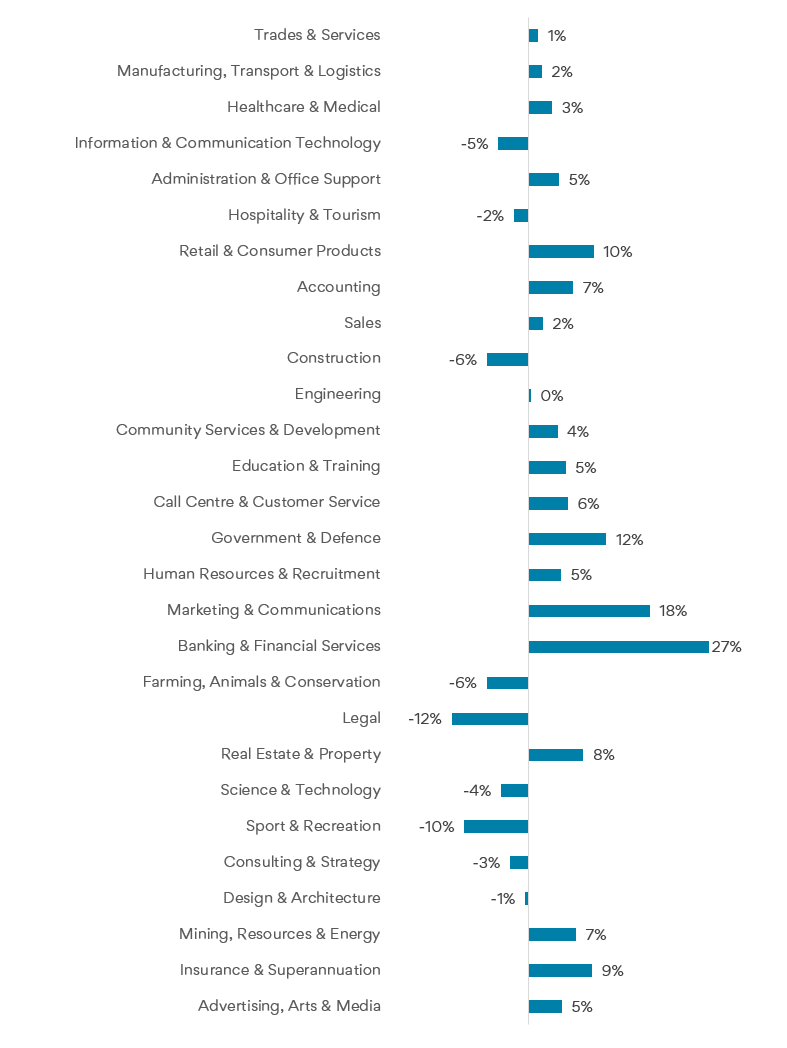

- Rises in Retail & Consumer Products (10%) and Marketing & Communications (18%) roles drove total job ads up in January.

- Information & Communication Technology (-5%) and Hospitality & Tourism (-2%) were the largest industries (by job ad volume) to record a decline in job ads.

ABOUT THE SEEK NZ EMPLOYMENT REPORT

The SEEK Employment Report provides a comprehensive overview of the New Zealand employment marketplace. The report includes the SEEK New Job Ad Index, which measures only new job ads posted within the reported month to provide a clean measure of demand for labour across all classifications. SEEK’s total job ad volume (not disclosed in this report) includes duplicated job advertisements and refreshed job ads. As a result, the SEEK New Job Ad Index does not always match the movement in SEEK’s total job ad volume.

NOTES

(1) The SEI may differ to the job ad count on SEEK’s website due to a number of factors including: a) seasonal adjustments applied to the SEI; b) the exclusion of duplicated job ads from the SEI; and c) the exclusion of Company Listings (included under Company Profiles) from the SEI

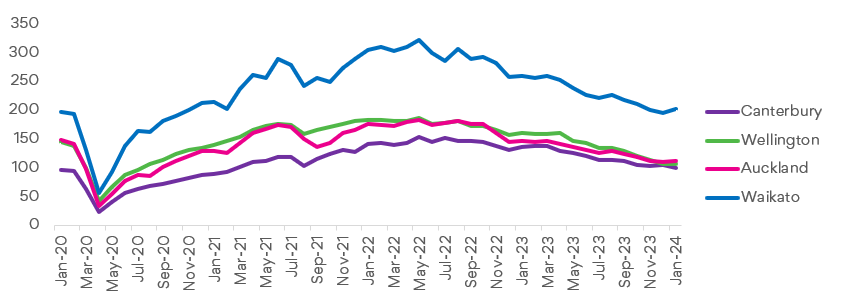

(2) The Covid-19 pandemic led to a high level of volatility in labour market data between April 2020 and March 2022. As a result, caution is recommended when interpreting trend estimates during this period as large month-to-month changes in variables generated multiple trend breaks

(3) The applications per ad index contains a series break at Jan 2016 when the calculation of this series changed from using gross variables (inclusive of all SEEK job listings) to net variables (removing duplicate job listings). This change has a negligible impact on recent data points, but caution is recommended when interpreting data immediately following the series break, and particularly in 2016 where growth rates have not been adjusted for the series break.

DISCLAIMER

The Data should be viewed and regarded as standalone information and should not be aggregated with any other information whether such information has been previously provided by SEEK Limited, ("SEEK"). The Data is given in summary form and whilst care has been taken in its preparation, SEEK makes no representations whatsoever about its completeness or accuracy. SEEK expressly bears no responsibility or liability for any reliance placed by you on the Data, or from the use of the Data by you. If you have received this message in error, please notify the sender immediately.