SEEK NZ Employment Report - Job ads fell in November, but remain higher than pre-pandemic

NOVEMBER 2022 KEY FINDINGS:

NATIONAL INSIGHTS:

- Job ads fell 8% month-on-month (m/m) and are 29% higher compared to November 2019.

- Applications per job ad increased 4% from the month prior.

REGION INSIGHTS:

- Every region recorded a drop in job ads m/m except Gisborne, which rose 17%.

- Nine regions recorded a year-on-year (y/y) decline in job ads, including Auckland (-1%), Wellington (-7%) and Bay of Plenty (-10%).

- Applications per job ad rose in most regions m/m, including 6% in Auckland.

INDUSTRY INSIGHTS:

- Two small industries recorded an increase in job ads m/m, while all others recorded a fall.

- The industries driving the overall decline in job ads m/m were Administration & Office Support (-12%), Hospitality & Tourism (-10%) and Trades & Services (-7%).

- Applications per job ad increased in the largest industries by volume, including Manufacturing, Transport & Logistics (5%), Trades & Services (5%) and Information & Communication Technology (6%).

Rob Clark, SEEK NZ Country Manager says:

“The job market has eased since record-level job ad volumes in May, and the proximity to Christmas has led to job ad numbers dropping nationally month-on-month. Despite the drop, job ad volumes in all regions and most industries remain high in comparison to pre-pandemic.

“The Manufacturing, Transport & Logistics, Healthcare & Medical and Hospitality & Tourism industries are experiencing talent demand significantly higher than 2019 levels, even as we move away from the peak levels of earlier this year.

“Candidate activity is also generally expected to quieten at this time of year, but applications per job ad are picking up as job ads are moderating, with all of the largest industries recording increases month-on-month.”

NATIONAL INSIGHTS

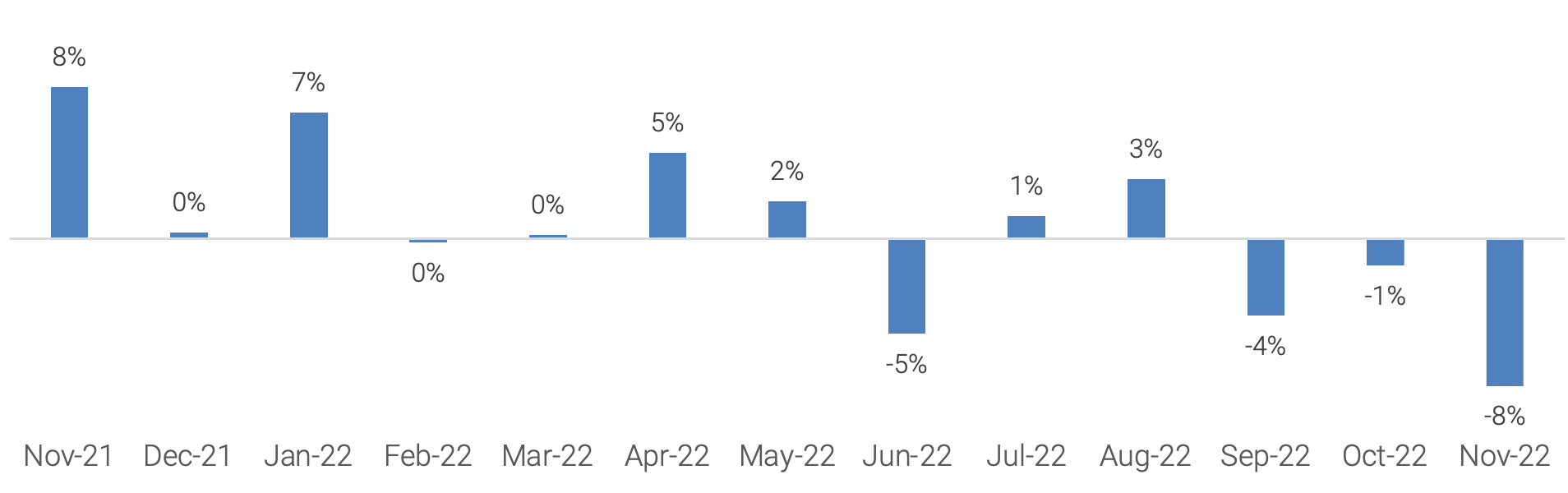

Job ads fell 8% m/m, and for the first time since February 2021 are now slightly lower y/y (-2%). Job ads remain 29% higher than November 2019 nationally.

Administration & Office Support (-12%), Hospitality & Tourism (-10%) and Trades & Services (-7%) were the three industries that drove the overall decline.

Applications per job ad rose for the ninth consecutive month, this time by 4%, due to increases in all of the large hiring industries.

Figure 1: National SEEK job ad percentage change m/m November 2021 to November 2022

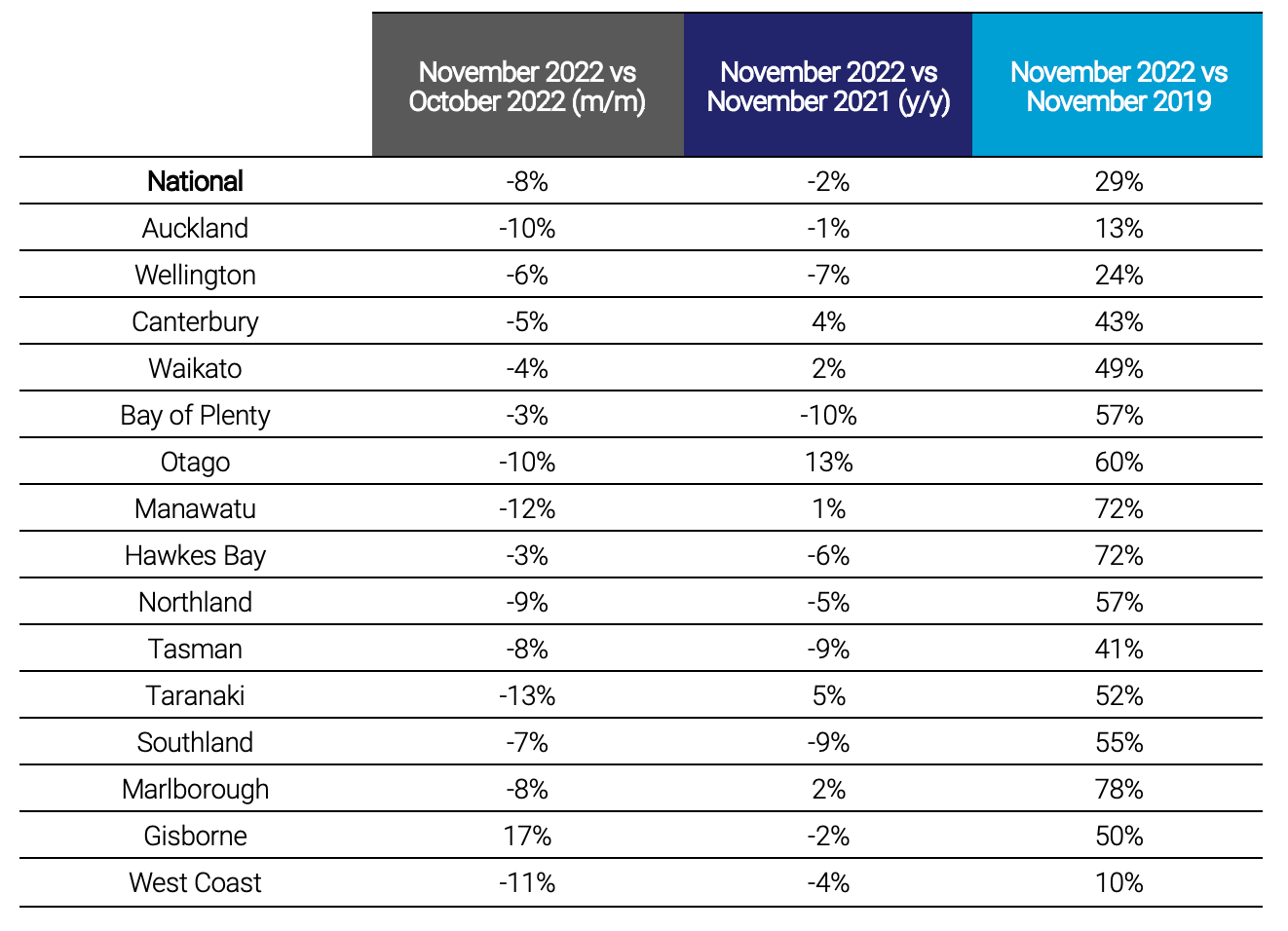

Table 2: National and regional job ad growth/decline comparing November 2022 to: i) October 2022 (m/m); ii) November 2021 (y/y) and iii) November 2019.

Table 2: National and regional job ad growth/decline comparing November 2022 to: i) October 2022 (m/m); ii) November 2021 (y/y) and iii) November 2019.

REGION INSIGHTS

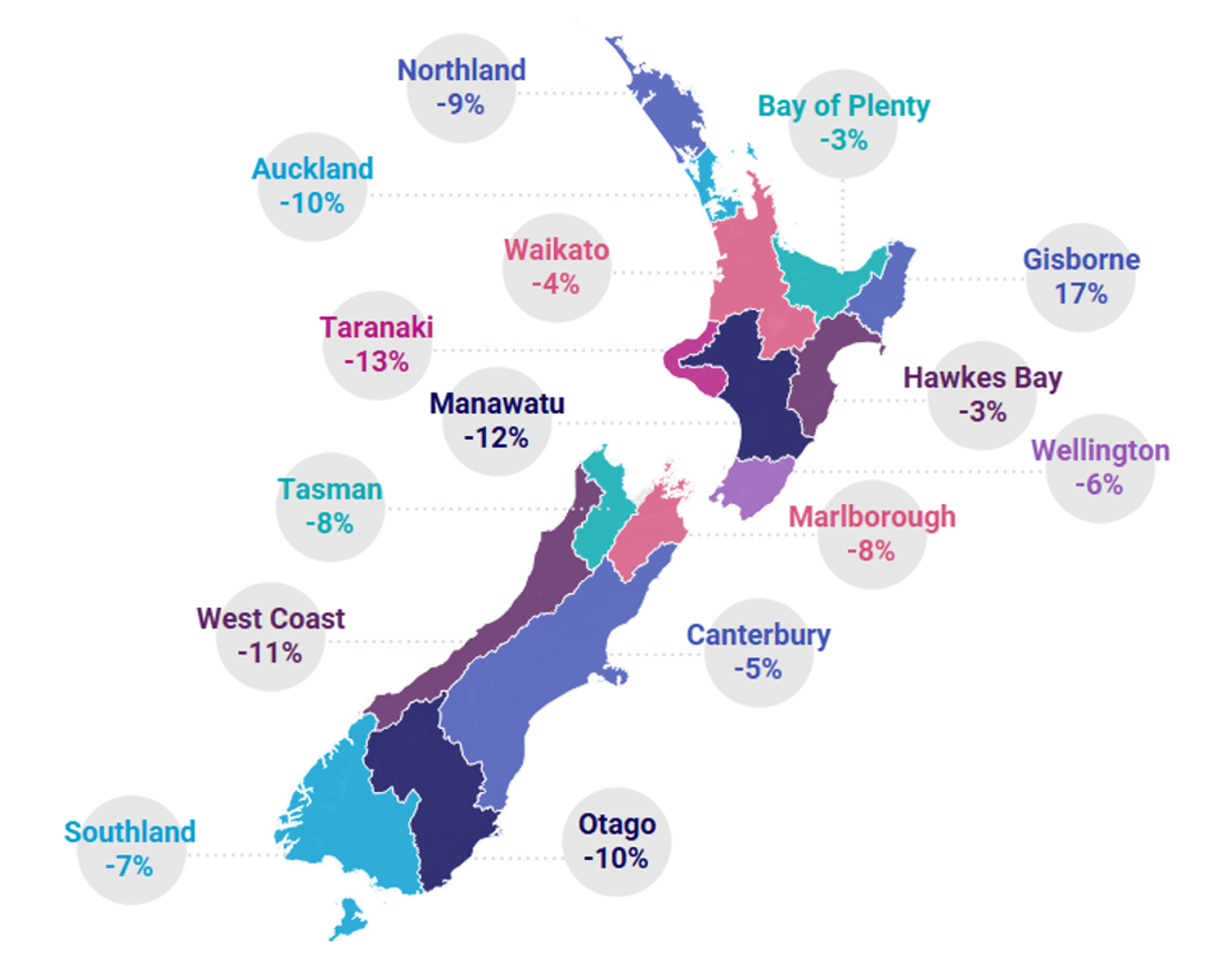

Every region recorded a m/m decline in job ads in November except Gisborne which increased 17%. The largest were in Taranaki (-13%), Manawatu (-12%) and West Coast (-11%).

Job ads in six regions have increased y/y, the greatest of which are Otago (13%), Taranaki (5%) and Canterbury (4%). Job ads in every region remain higher than November 2019 levels.

Applications per job ad increased from the month prior in all but three regions, Manawatu, Tasman and West Coast and grew y/y in all regions but West Coast where there was no change.

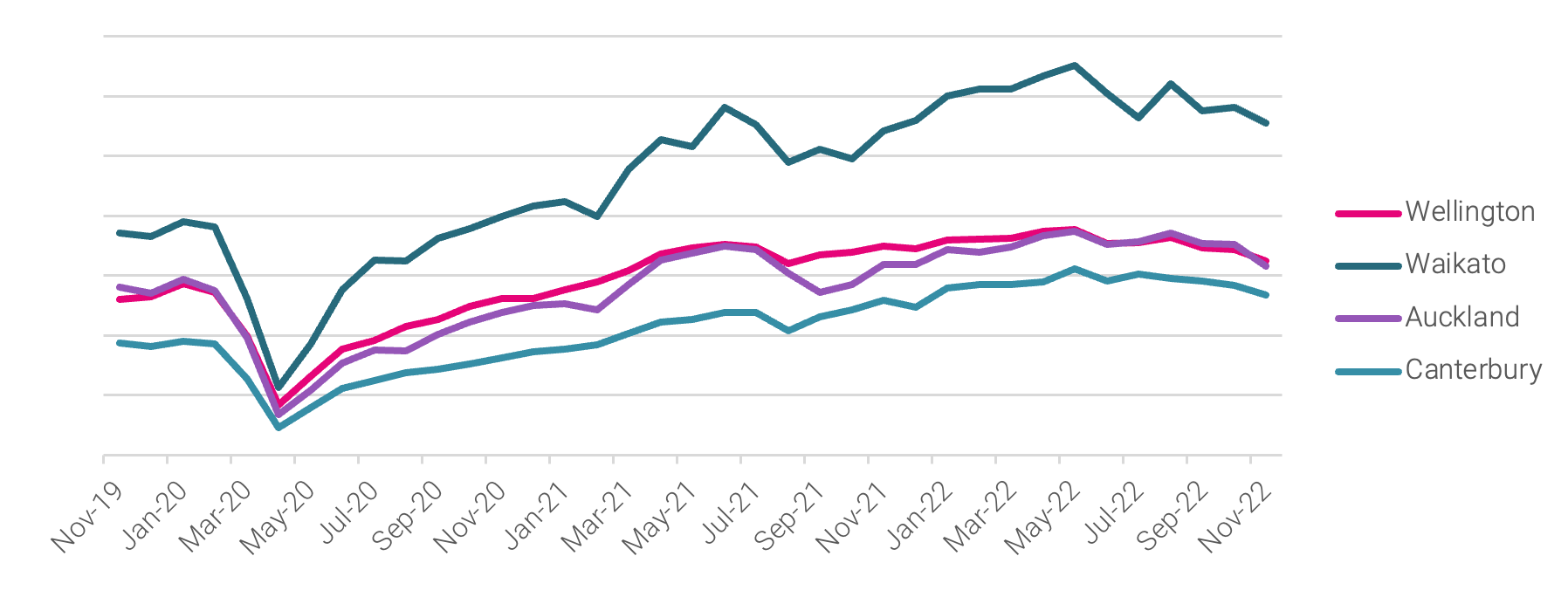

Figure 2: Major region job ad volumes – November 2019 to November 2022

Figure 3: National SEEK job ad percentage change by region (November 2022 vs October 2022).

Figure 3: National SEEK job ad percentage change by region (November 2022 vs October 2022).

INDUSTRY INSIGHTS

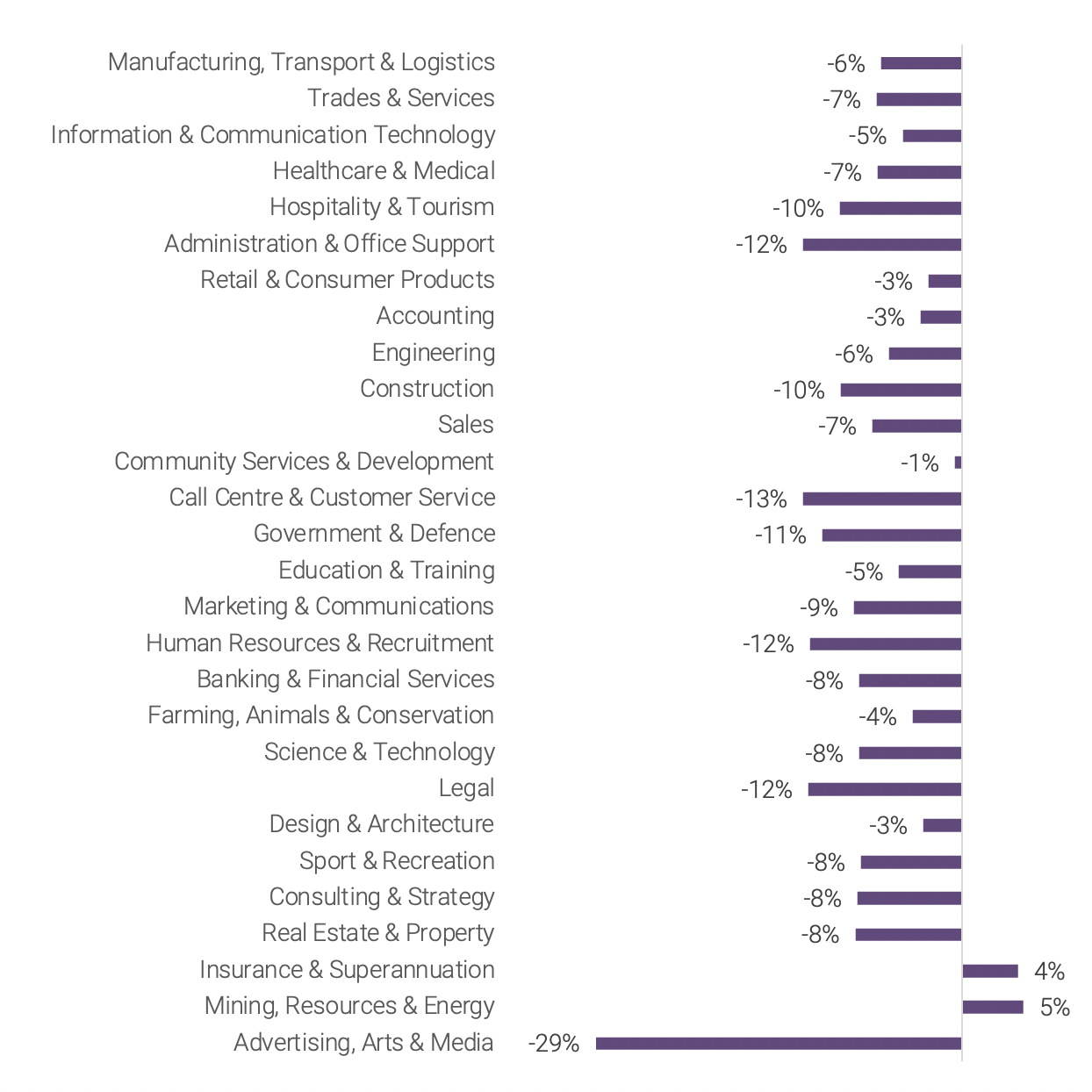

Only two industries recorded a m/m rise in job ads in November, Insurance & Superannuation (4%) and Mining, Resources & Energy (5%). All other industries fell, with the overall decline driven by Administration & Office Support (-12%), Hospitality & Tourism (-10%) and Trades & Services (-7%).

Job ad volumes remain higher y/y in eleven industries, notably Hospitality & Tourism which is still 57% higher than 2021, with ads for Chefs/ Cooks up 70%, Wait Staff up 37% and Front Office and Guest Services up 89%.

Applications per job ad grew m/m and y/y for the largest industries, including Manufacturing, Transport & Logistics (5% m/m), Trades & Services (5% m/m) and Information & Communication Technology (6% m/m).

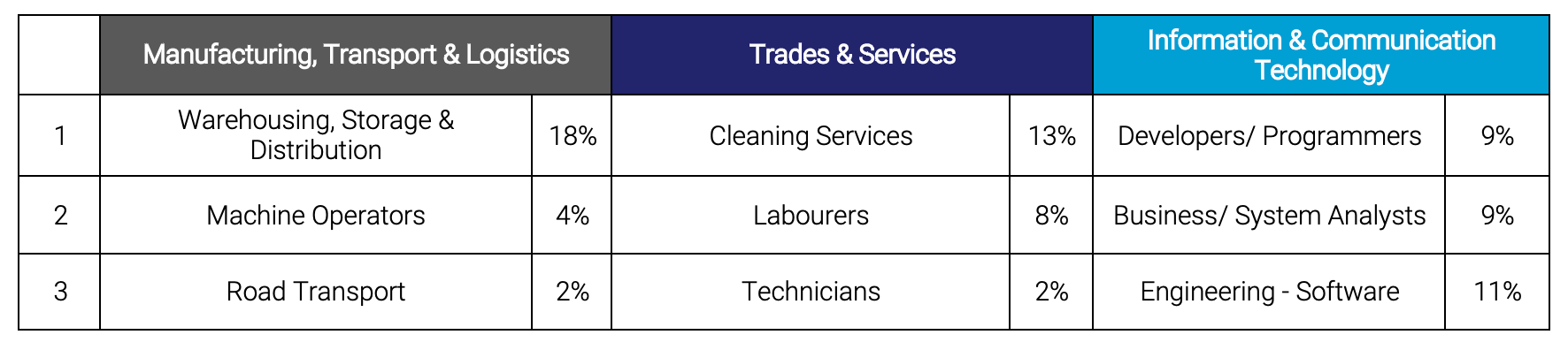

Table 3: Examples of role types where applications per job ad increased m/m in October.

Figure 4: National SEEK job ad percentage change by industry (November 2022 vs October 2022) – Ordered by job ad volume

Figure 4: National SEEK job ad percentage change by industry (November 2022 vs October 2022) – Ordered by job ad volume

Click for the latest SEEK Employment data or for more employment insights or career advice please visit SEEK’s Hiring Advice or SEEK's Career Advice.

MEDIA NOTE: When reporting SEEK NZ data, we request that you attribute SEEK NZ as the source and refer to SEEK NZ as an employment marketplace.